21

Jun

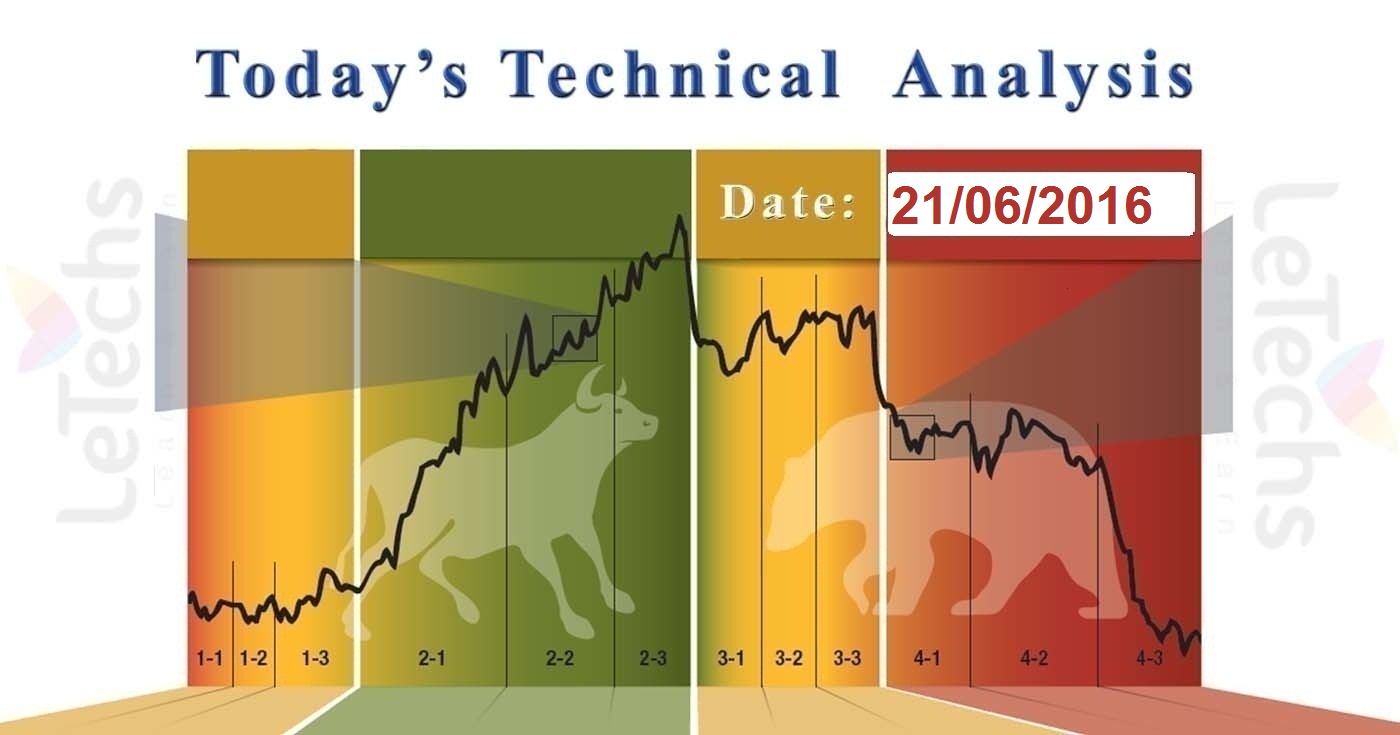

Daily Technical Analysis on 21st June 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, Brent-Crude Oil, & XAUUSD.

EURUSD

No significant news was published on Yesterday & only the Fed representative Neel Kashkari's speech was the focus of our consideration. The last day trades begin with a growth. The pair will grow to the upper border of the descending channel. The indicators confirm some short positions. The resistance remains at 1.137 levels, the support remains at 1.1300 levels.

MACD indicated the current growth. If MACD rebound to reduce there will be a sell signal. RSI is near to the overbought region. The growth into overbought zone will signs a buy signal. Reduce of the signal line will seems a sell signal. The Moving Averages of 50, 100 & 200 are parallel to one on one. It directions are horizontal. The pair is still below pressure. The bulls’ bid to modify the market declined. If the level 1.125 is smashed downhill the value will reduce to 1.113 levels. Conversely we might see a growth to the levels of 1.1450 – 1.1500.

GBPUSD

On Last day, the pound strengthened across other key currencies when panic that the UK might depart the European Union weakened. The latest poll conclusion revealed that the number of Britain’s who prefer to remain in the EU is likewise the number of those who wants to depart it. The pound bounced back previous week & constant growing this week as well. The pair put a fresh local high at the mark level of 1.4700. According to the daily time frame the resistance level of 1.4670 is a solid level where the value reverses many times. The resistance remains at 1.4670, the support stands at 1.4560 levels.

The pound will grow to the upper border of the descending channel. The value is over the Moving Averages of 50, 100 & 200 on the 4Hr time frames. The Moving Averages are twisting upwards direction. RSI is in the overbought point of 70. The oscillator shows a buy signal until it remains in the overbought region. The resistance level of 1.4670 limits improves of the pair. This is a solid level which the pair might not break from February, 2016. If the pair smashes the level the growth will be sustained. Diversely we will see a rebound under the level of 1.4400.

USDJPY

The dollar will rise across the yen, retreating since an almost 2-year low touched previous Thursday when the BoJ-Bank of Japan left its monetary policy unmodified. Investors believe that the Bank would implement further stimulus. The pair stands in a downside channel. The dollar is yet below pressure. The pair put a fresh local low at 104.00 levels. The resistance stands at 104.50 levels, the support remains at 103.50 levels.

MACD indicates a sell signal. RSI is near to the oversold region. If RSI brings into the oversold region we will receives a sell signal. USDJPY pair is under the Moving Averages of 50, 100 & 200 on the 4HR chart. We anticipate its additional decline towards the level of 103.50. Conversely we intend to see a growth up to the level of 106.00.

Brent – Crude Oil

The oil quotes will rise on Monday when burden that Britain would depart the European Union reduced. The weak dollar also sustained the Brent quotes. The oil quotations will keep growing. The value left the descending channel. The Brent was adept to return to 50.50 levels. The resistance remains at 50.50 levels, the support stands at 49.50 levels. RSI access the overbought level of 70. If RSI brings into the overbought region we will get a buy signal. The Brent ruined all Moving Averages of 50, 100 & 200. If the oil build-up over them the buyers turn into stronger.

We trust the growth will be constant. The level 50.50 limits improve of the Brent. A crack on top of this mark risks a growth hind towards the resistance levels at 51.50.

XAUUSD

Demand for safe capitals reduced, the metals futures got below pressure. The value moved away since a 22-month high previous week. The strengthen market sentiment also commit to the strengthening of the dollar. The whole outlook signed bullish despite the recent alteration. The pair spent the full day close to the level of 1280. All bids to smash the level down had declined. The resistance stands at the level of 1300, the support stands at the levels of 1280.

MACD histogram reduced. RSI left the overbought area of 70. If the value returns to the overbought region we will get a buy signal. The value is over the Moving Averages of 50, 100 & 200. It directions are upwards. If we see additional bid to crack the support level of 1280 the chances for a alteration will grow. In the meantime, pair might recover to the level of 1315.