20

Jun

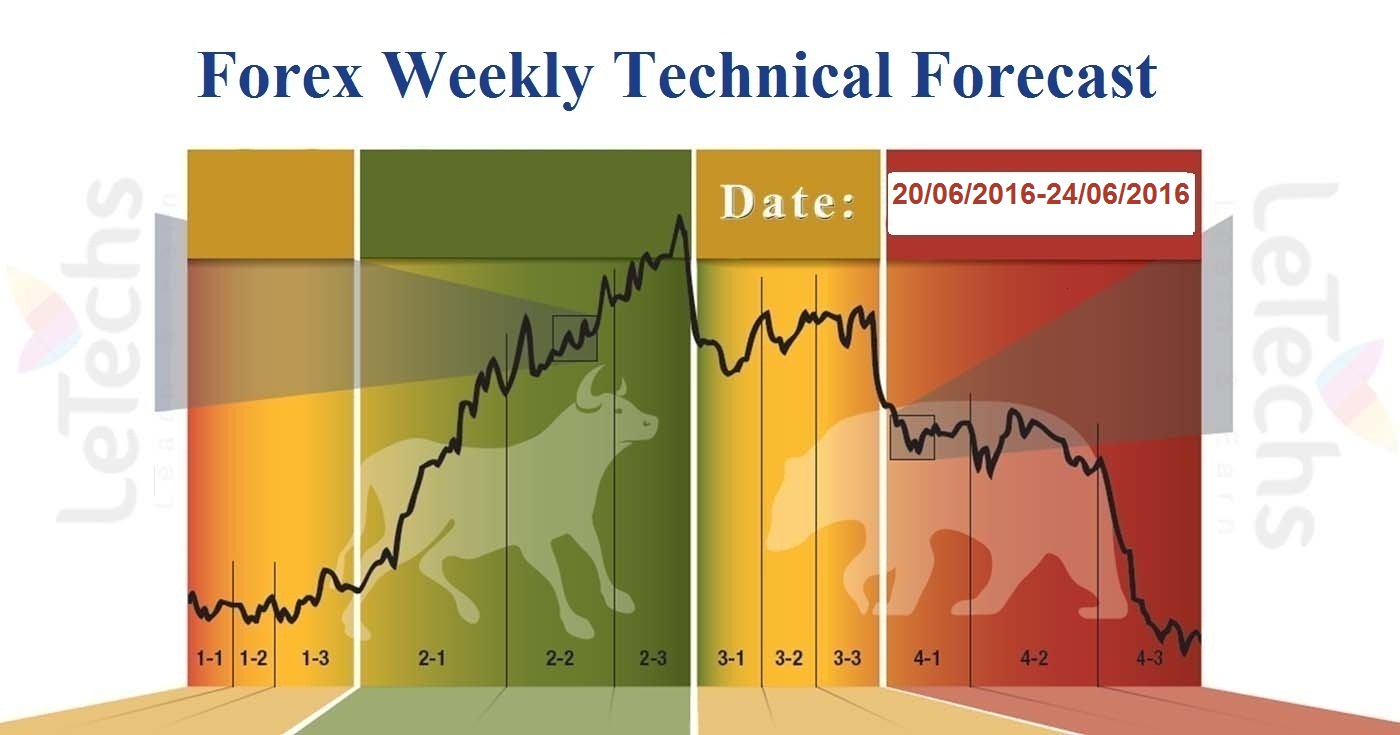

Weekly Forex Technical Analysis on 20 - 24 June 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD & USDJPY

EURUSD

EURUSD vibrated on the market tendency, suffering from the modifying sentiment about the British EU Referendum. Excluded from the event itself, we have major German surveys & PMIs. A UK exit of the European Union is also appearing as a danger for the euro-zone. When assessment polls showed a stronger lead for the depart campaign, the euro be affected very much. When the pound returned, the euro followed. Somewhere, inflation numbers were proved at low levels for May but industrial result surprised to the upside. In US, the Fed was exactly dovish, but the dollar weakness that pursued did not last on its own, either do the positive retail sales. The next week will see the completion in the UK, the euro-zone & for some other currencies as well.

Euro-dollar started the week supported level of 1.1230. It then covered too much lower ground at the level of 1.1130 earlier bouncing back up in a high-unstable week. Brexit appears more & more real and this weighs strongly on the euro as well. It might be the beginning of the end of the European Union & the euro-zone. A definite victory for Bremain, which yet has good chances, will also depart unlocks wounds in the UK & in the continent. Only a far victory for stay would move the euro higher. European data will definitely not help; as the green shoots shown on first quarter might be behind us. EURUSD remains Bearish this week.

GBPUSD

GBPUSD entwisted the directions earlier week & posted well-built gains. The pair gained regarding 150 points & closed at the level of 1.4343. This week’s key event of GBP is the EU Membership referendum. In the UK, Retail Sales showed a strong gain & beat anticipations. In the US, the Fed firm rates & gave no hints regarding a rate hike. Retail Sales were by means of predictions, whilst inflation levels stays low, as underscored by previous week’s CPI reports. GBPUSD unlocked the week at 1.4186 levels & mounted to a high of 1.4387 levels. The pair after reversed directions & fell down a low of 1.4010 levels, testing the support levels at 1.4036. The pair blocked the week at 1.4343 levels.

The Brexit vote might see sharp volatility dominant up the vote, with the result pretty much in the air. A vote to depart the EU will have huge consequences for the UK & the continents, & might see the pound fall sharply. Alternatively, a vote to stay in the EU would fairly be bullish for the pound. GBPUSD remains Neutral.

AUDUSD

AUDUSD finished last week almost unmodified, closing at the level of 0.7366. This week’s major event is Unemployment Change. Australian job figures were solid, as Employment Change showed strong gains. In the US, the Fed firm rates & gave no hints regarding a rate hike. Retail Sales were by means of predictions, whilst inflation levels stays low, as underscored by previous week’s CPI reports.

AUDUSD pair unlocked the week at 0.7371 levels & reached a high of 0.7446 levels, testing the resistance at 0.7438 levels. The pair after that modified directions & dropped to a low level of 0.7285. AUDUSD then bounce back & clogged the week unmoved at the level of 0.7367. The Fed remained on the sidelines previous week, & might stay out of the highlight until September. The next Brexit referendum might have muscular ramifications on the currency things, even on the Aussie. AUDUSD remains Neutral.

USDJY

USDJPY seems sharp losses earlier week, as the pair chop down 240 points. The pair clogged just over the 104 line, its lowest weekly close from August 2014 itself. This week has 5 key events on the schedule. The yen surged previous week, as the BOJ- Bank of Japan abstain from any easing changes. In the US, the Fed firm rates & gave no hints regarding a rate hike. Retail Sales were by means of predictions.

USDJPY pair unlocked the week at 106.48 levels & reached a high of 106.64 levels. The pair then entwisted directions & cut down a low of 103.50 levels, breaking earlier support at 104.25 levels. USDJPY blocked the week at 104.05 levels. Along the BoJ showing no appetite for additional easing, the yen might sustain to move near to the symbolic 100 level. The Fed also stayed on the sidelines previous week, & might refrain since a rate rise until September or even later.