06

Jun

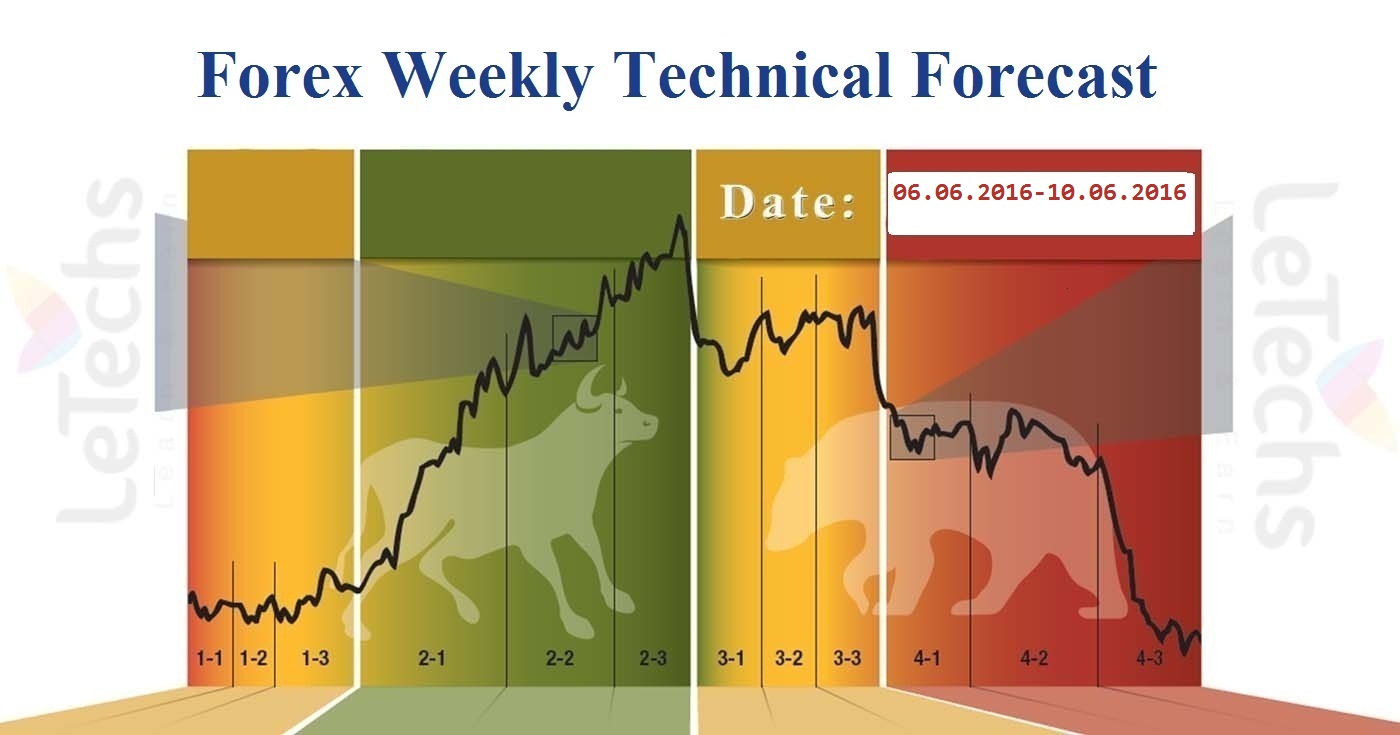

Weekly Technical Forecast on 6th-10th JUNE 2016

Forecast Technical Pairs: EURUSD, GBPUSD, AUDUSD, & USDJPY

EURUSD

EURUSD was looking for a fresh direction & certainly found it: an upside endeavor on the rear of a weak US dollar. Draghi will have another chance to improve the euro in the upcoming week. Mario Draghi made his good efforts not to slab the boat with minimum modifies to forecasts & a general “wait & watch” mode as the previous measures announced in March are awaiting exertion at present. Eurodollar had a relatively equitable week, trading mostly at the level of 1.11 handle, identical to last week. But after that, on Friday, it trigger higher, touching a high of 1.1373 levels previously settling a bit lower.

EURUSD remains Neutral. The awfully poor job reports in the US were certainly a shocker. When the dirt puts, the USD could re-make as the cleanest shirt in the dirty chunk as the situation in Europe doesn’t look too best & a US July rise cannot be damaged, at least not now. Nonetheless, at the moment we may see the pair get suitable on much higher floor.

GBPUSD

GBPUSD posted strong cut down last week, fell down 120 points. The pair closed the last week at the 1.45 levels. This week’s GBP key event is Manufacturing Production. British Manufacturing PMI released in at 50.1, pointing to no improve in the manufacturing area. Around in the US, Non-Farm Payrolls shocked the markets place with dreadful benefit of only 38K jobs. GBPUSD opened the week at 1.4621 levels. The pair mounted to a high of 1.4725 levels, as resistance held hard at 1.4752 levels. The pair after that reversed sides & fell to a low of 1.4384 levels. GBPUSD remains Bearish.

AUDUSD

AUDUSD bounce back sharply previous week, mounting close to 200 points. The pair closed at 0.7363 levels, its highest weekly close from the April. RBA- Reserve Bank of Australia cash back is the key event for AUDUSD. In Australia, Building Approvals & GDP fascinated with strong growth. AUDUSD unlocked the week at 0.7178 levels & rapidly touched a low of 0.7148 levels. AUDUSD then modified directions & mounted to a peak of 0.7368 levels, breaking last resistance at 0.7334 levels. AUDUSD remains Bearish this week.

USDJPY

USDJPY- yen had a fantastic week, as the pair plunged over 400 points earlier week. The pair clogged at the level of 106.51, this is the lowest level in last 5weeks. This week’s JPY highlight is Final GDP. Japanese consumer indicators were not impressive, as Retail Sales & Household Spending both posted decreases. Over in the US, Non-Farm Payrolls horrors the markets place with disastrous return of only 38K jobs. The US dollar was highly inferior on Friday as a final, & the yen took full advantage, reaching sharp growths. USDJPY unlocked the week at 110.77 & touched a high of 111.45. The pair after that reversed directions & cut down to a low of 106.38, as support held strong at 106.25 levels. USDJPY blocked the week at 106.51. USDJPY remains Neutral.