03

Jun

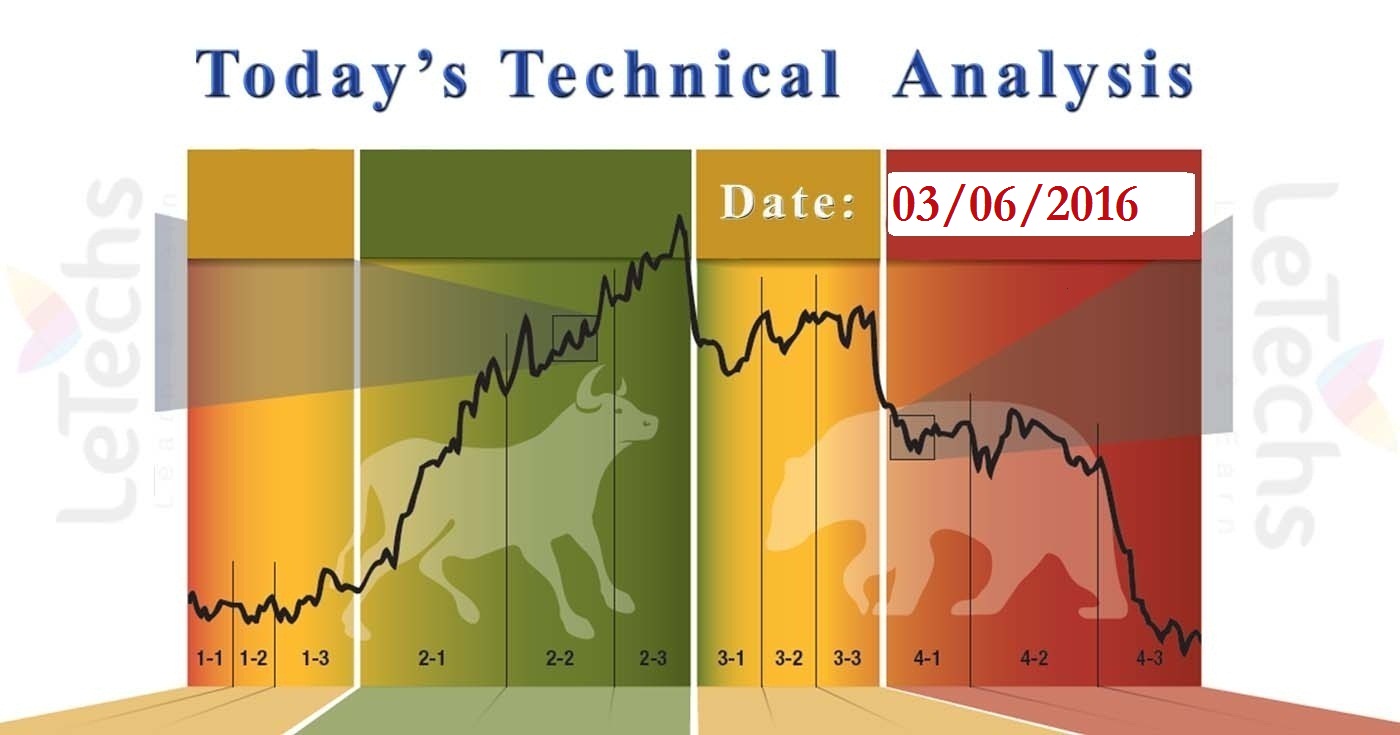

Daily Technical Analysis on 3rd June 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD, USDJPY,XAUUSD,Brent- Crude Oil

EURUSD

The ECB meeting was the key event in the Euro zone this week. The European controller left the rate unmodified. ECB meeting conclusion weakened the euro currency, at the equal time the heavy unemployment statistics in the US promoted the dollar. The euro falls down on Yesterday due to the macroeconomic reports in Europe & the US. The pair might not hold at 1.1200 levels, & dropped down. The level of 1.1155 became the provisional minimal of the last day. We consider that sellers are following & they will return the pair more down.

The resistance remains at 1.1200 levels, the support remains at 1.1130 levels. MACD kept reducing signs a sell signal. RSI surround the oversold point of 30. The downhill movement will be constant. The pair might go to 1.1130 levels early. Following the target levels will be 1.1070.

GBPUSD

The British currency is still unstable following the latest poll regarding the UK membership in the EU. According to the poll the figures of Britons who want departing the EU improve vs. those who suggest staying in it.

Pound remained in the horizontal after a new sharp reduce. The pair stayed in the area 1.4400 – 1.4480 levels. The market place needs a smash to restore from the losses. The resistance level of 1.448, the support level of 1.4400. MACD indicates the bearish signal. RSI signs will be oversold.

AUDUSD

The Australian dollar cut down after the retail sales information in Australia. The index will come worse than anticipated. The RBA- Reserve Bank of Australia might low its interest rates to 1.0 percent from the present 1.75 percent. The next RBA conference will take place on 7th June 2016. The Australian dollar stayed in a horizontal line. AUDUSD pair was traded close to the mark of 0.727 levels.

From a technical point of view the pair signs bearish. The resistance stays at 0.7270 levels the support stands at 0.714 levels. MACD signs the pair decreasing. RSI stands in a neutral zone indicating no signal. If the value fixates under the support of 0.714 levels, it might sustain the downhill trend in the short term period. The potential targets are 0.704 levels. We do not prohibit the rise to 0.727 levels.

USDJPY

The dollar in the USDJPY cut down when Japan suspended the planned sales tax raise. The Japanese government determined to move since the monetary policy moderate to economic stimulus.

The yen sustained falling. USDJPY pair put a fresh local low level at the mark of 108.80. The pair cracks the level of 109.00 & blocked to consolidate. The resistances are 109.00, the supports are 108.20. MACD signs a sell signal but RSI touched the oversold level of 30. We pretend the horizontal movement will be constant.

XAUUSD

XAUUSD- Gold lost few of its positions on Thursday. The pair cracks the level 1215 downhill movement. The pair did not move wide & clogged at 1209.5 levels. The yellow metal needs fresh drivers to sustain its moving. The resistance level was 1215; the support level was 1200. MACD signal is bullish. RSI signs a neutral zone offering no signal.

BRENT – Crude Oil

The Brent quotes improve following the OPEC meeting in Vienna. The OPEC determined not to restrict its production & left the quotes at the equal level. The Brent exhibit active trades on last day. The OPEC meeting was the key driver for the oil quotes. The pair reduced at the European conference & clogged over the support of 48.60 levels. The support turns into the pivot level where the Brent oil develops to the resistance of 50.50. The resistance lies at 50.50, the support lies at 49.60 levels. We pretend the pair will go to 50.50 levels first. Having beaten the first target the value may go uphill to 51.50 levels.