01

Jun

Daily Forex Trading Technical Analysis on 1st June 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, USDCAD & Brent – Crude Oil.

EURUSD

Euro Zone this week’s key event is ECB meeting. We admit that the European controller will not make any modify to its monetary policy. The pair pursued to recover on Yesterday. After a few consolidations on Monday, the pair rebound the part of the earlier losses. By the final of trades & tested the 1.1130 levels. The resistance finds at 1.1200 levels; the support finds at 1.1130 levels.

MACD signs reduced giving a sell signal, but RSI remains in a neutral zone. If the value fixates under the support 1.1130 levels, it might sustain the downhill trend in the short term period.

GBPUSD

Pound resumed its downturn. In natural, the dollar survives strong against the pound after Janet Yellen’s statement on last week. The market place anticipates new drivers for a more movement. The pair falls down on last day. Following a false breakout of 1.467 levels the pair fell down to 1.448 levels. Resistance stands at the level of 1.456, the support stands at the level of 1.4480.

MACD indicator constantly their declines a sell signal. RSI signal level is nearly to the oversold zone. The potential reduce target is two levels of support: 1.4480 & 1.4400 levels.

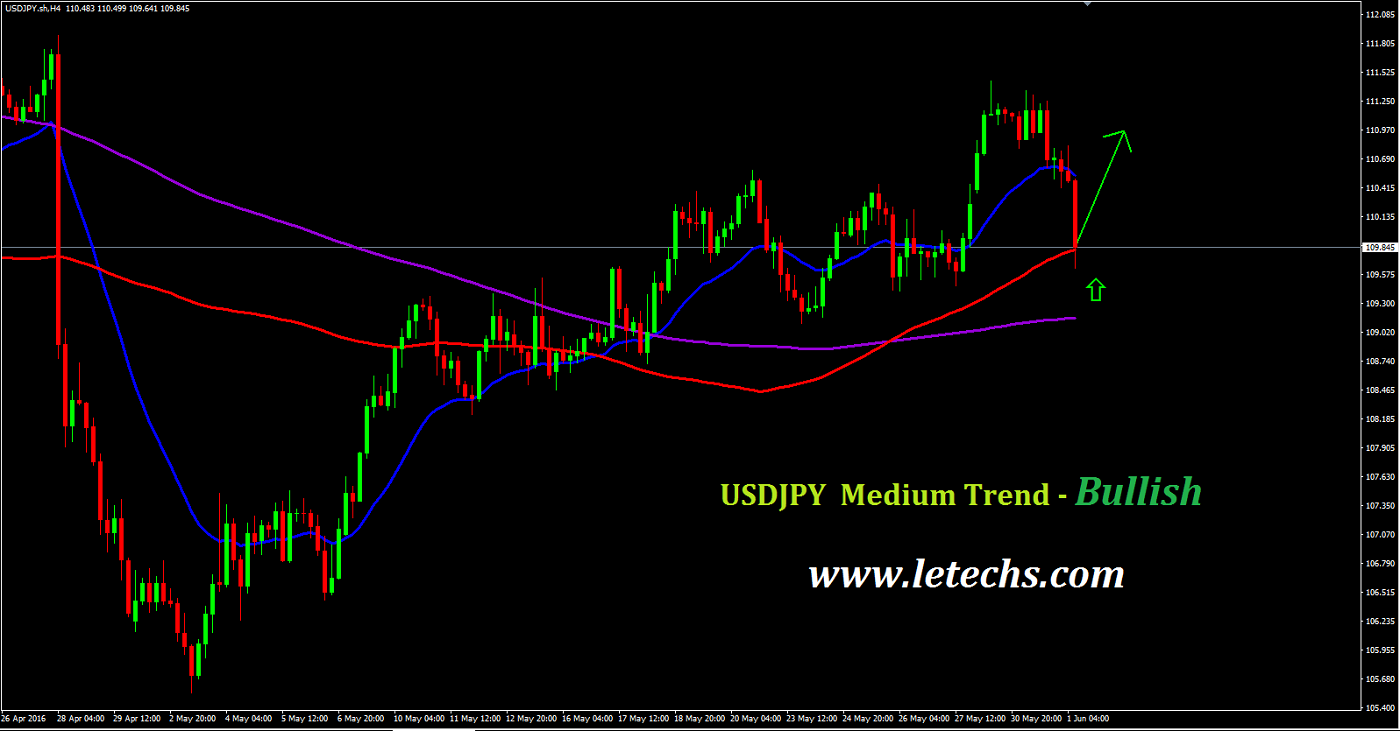

USDJPY

USDJPY pair returned over the level of 110.40 among the dollar growth. The Prime Minister of Japan Abe decided to holdup the rise in sales tax to 2.5 years. The quotes made try to smash through the level of 111.40. USDJPY pair was in a narrow area of 110.60 - 111.33 full days. The resistance level was 111.40, the support level was 110.60.

MACD signs bearish signals. RSI indicates neutral. If the value fixates under the support 110.6 levels, it might sustain the downhill trend in the short term period.

USDCAD

USDCAD stands bearish on the outlook for the currency. If the Canadian economy sustains weakening, the value might decline deeper. The pair grew on yesterday & touched the resistance level of 1.3100. Its more movement depends whether the pair will crack it or will rebound off from the resistance levels 1.3100. We predicts the 1.3100 line smashed that will unlock the path for the buyers to 1.3200 levels.

BRENT – Crude Oil

Crude oil prices became unsettled on the eve of the OPEC meeting on the 2nd of June. We consider that OPEC will not modify anything in exporting policies. The market place looks bullish at the superior timeframes. The oil increases the whole day on yesterday & tested the level of 50.50. Then the value fell down to the level of 49.60. The resistance level of 50.50, the support level of 49.60.

MACD indicates a buy signal. RSI remains neutral. The oil prices can rise to the resistance level of 50.50. After cracking through 50.50 the buyers might go to 51.50.