27

May

Daily Technical Analysis on 27th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, & USDCHF.

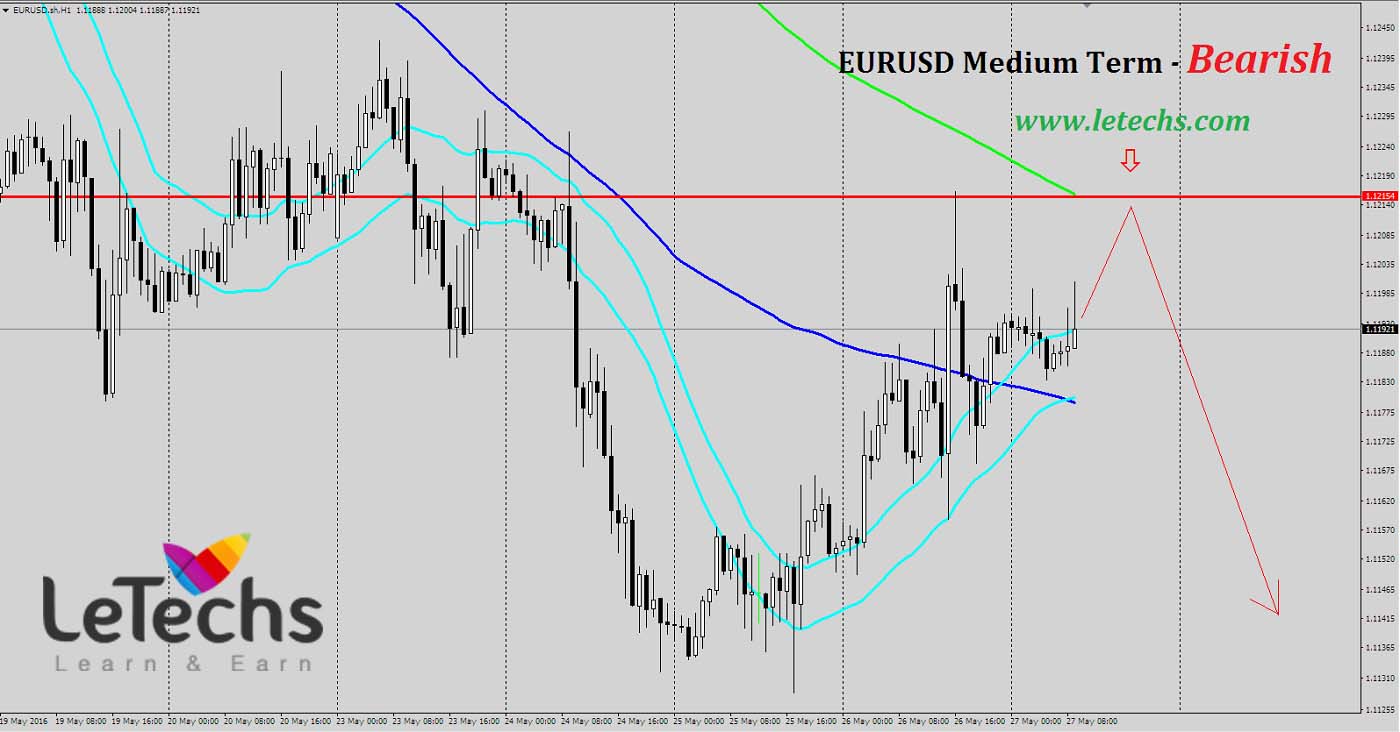

EURUSD

The Ten-year government bonds in Germany reduced which decreased the attractiveness of the European capitals. The improving "risk appetite" in the world set pressure on the protected capitals; such as the special European currency. Nonetheless the pairs of Euro/Dollar strong.

The 1st support remains at the level of 1.113 & subsequently at 1.107 levels. The 1st resistance remains at the level of 1.1200, the other one is at 1.125 levels. It’s an established & a strong sell signal. The value is prospecting. We consider the 1.125 line crack that will unlock the technique for the buyers to 1.1300 levels.

GBPUSD

GBPUSD- revised GDP statement for the first quarter of this year was the key event in the UK. The index stays at the same level at 0.4 percent.

The value finds the first support at 1.456 levels; after those 1.448 levels. The value finds the first resistance at 1.467 levels; the others are at 1.476 levels. It’s a definite & a muscular buy signal. If the values fixate under the support level of 1.456, it might sustain the downhill trend in the short term. The potential targets are 1.448 levels.

USDJPY

The yen blocked to develop on Yesterday. Previously it increased as corporate services value index will raise. Corporate Service Price index raised by 0.2 percent year on year, as anticipated. The US released Durable Goods Orders are 0.4 percent vs. anticipations 0.3 percent & Initial Jobless Claim was 268K vs. predicts 275K.

The value verdicts the first support at 109 levels, the other one is at 108.2. The value verdicts the first resistance at 109.8 levels, subsequently at 110.6 levels. We consider that reduce will be constant now. The first target levels are 109, afterwards 108.2 levels.

USDCHF

Yesterday’s investor attention was acted to the weekly US labor market report – Initial Jobless Claim was 268K vs. predict 275K. Switzerland released Industrial Production was -2.2 percent vs. earlier -7.4 percent.

The first support stands at the level of 0.985, after those 0.975 levels. The first resistance stands at the level at 0.9940, the others are at 1.002 levels. It’s a definite and a burly buy signal. We advised going short period with the first target level of 0.985. When the value consolidates under the first target it might go to the level of 0.975.